Industry Overview

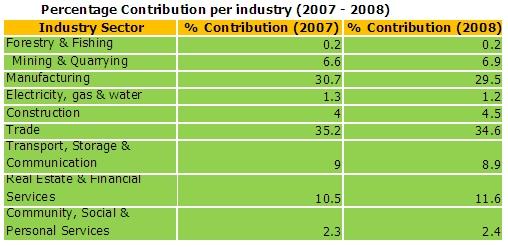

According to Statistics SA - Financial Annual Report 2008, the total turnover for the country was approximately R 4.9 trillion representing approximately a 20% increase over 2007. The various core components making up the country's GDP are as follows:

The sector accounts for 4.3% of the gross geographical product (GGP) of the province and for nearly 12% of employment. Mpumalanga is one of South Africa’s most productive and important agricultural regions. Agriculture is the third largest sector in Mpumalanga and the sector employs the largest number of people in the Province. The Southern and Northern Highveld regions are the main producers of field crops such as maize (20% of country production), grain sorghum, wheat barley, soy beans (58% of country production), sugar cane, and groundnuts. The major summer cereal produced in Mpumalanga is maize, while wheat is the major winter cereals. Sunflowers and cut flowers such as tulips and gerberas are also grown.

Mpumalanga plays a key role in South Africa’s position as a major exporter of fruit. South Africa is the world’s top exporter of avocados, tangerines and ostrich products, the second-biggest exporter of grapefruit, the third-biggest exporter of plums and pears, and the fourth-biggest exporter of table grapes. Other important export products include dairy, flowers, food, hides and skins, meat, non-alcoholic beverages, pineapples, preserved fruit and nuts, sugar and wine.

Crops

- Grain

- Fruit

- Vegetables

- Cotton

- Tobacco

- Nuts

- Flowers and plants

- Forestry & Paper

Mpumalanga produces one million tonnes of maize from 291 788 hectares. About 53 000 tonnes of wheat and 33 000 tonnes of sorghum are produced annually.

Subtropical fruit is farmed in large quantities. The district of Nelspruit accounts for a third of South Africa’s orange export output. Avocados, litchis, mangoes and bananas thrive in the province. Hazyview is an important source of bananas, with 20% of South Africa’s production originating in this district.

Deciduous fruits are cultivated in smaller quantities. Just over 15 000 tonnes of table grapes are produced in the province annually, and Mpumalanga produces its own wine.

A specialist fruit that does well in the province is the marula. The marula fruit makes a popular beer and is used in the production of a liqueur that has done well on the international market.

The higher areas of Mpumalanga and the Free State produce between them 40% of South Africa’s potato crop. Tomatoes, onions and cabbage are also farmed profitably.

Cotton is prominently grown in Mpumalanga, primarily in dry-land conditions.

There are more than 1 000 tobacco growers in South Africa, producing approximately 34 million kilograms of tobacco per year. Much of this production, especially Virginia tobacco, occurs in the north-western parts of Mpumalanga and in neighbouring Limpopo.

KwaZulu-Natal and Mpumalanga produce almost all of South Africa’s high-earning nuts like pecan and macadamia nuts. The provincial government has identified the latter as an area where it wishes to encourage investment. The possibilities for downstream beneficiation are many and varied.

Crops produced for export in Mpumalanga include cut flowers, pot plants and nursery plants. Snaps, Lisianthus and Delphiniums are among the flowers that thrive. Tulips are also cultivated in large quantities in this area.

Mpumalanga has extensive commercial forests and sophisticated processing plants dealing with everything from sawn logs, pulp and paper to board. The province has South Africa’s biggest sawmill and its largest panel and board plant, as well as the biggest integrated pulp and paper mill in Africa. Forestry accounts for 8% of Mpumalanga’s gross geographic product (GGP), and downstream production of paper and related products is an important part of the manufacturing profile of the province.

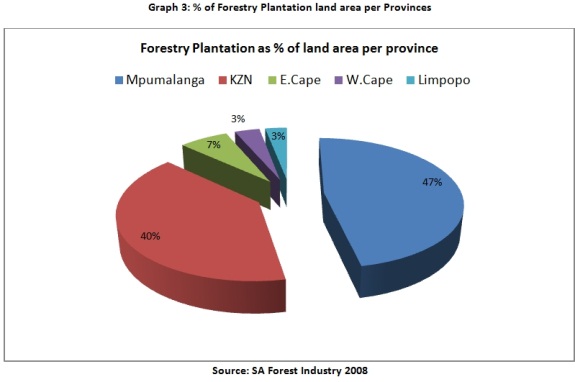

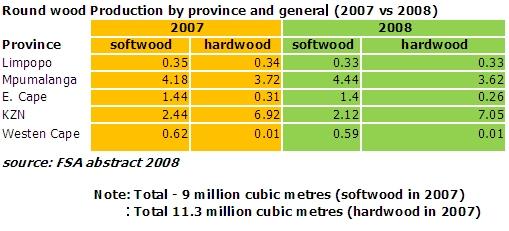

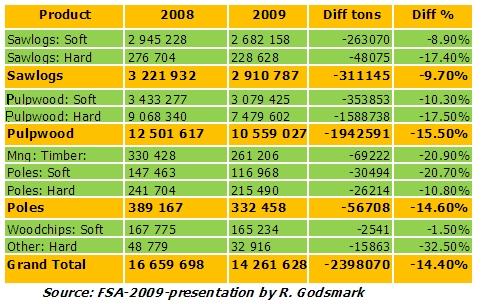

Forestry did not change in terms of contribution, but changes were observed in 2009 figures due to the recession that hit the country the first quarter of 2009. Tonnage sales for forestry declined by 14.4% despite the 128 cents/ton levy. In terms of quantities the level and business sizes operating in this sphere are presented by percentage contribution as below:

Institutional Framework

The forestry sector sits under the Department of Water Affairs and Forestry (DWAF). Additional key institutional arrangements come from the Department of Environmental Affairs and Tourism (DEAT) Department of Land Affairs, Department of Agriculture, and the Department of Trade and Industry. Influential protocols include, but are not limited to the following:

» National Legislation:- National Forests Act No. 84 of 1998 (NFA)

- National Environmental Waste Management Bill

- National Water Act of 1998

- National Air Quality Act (NAQA) - relates to processing, air pollution and those engaged in in recycling. This is the amended version of the APPA.

- 1965 Atmospheric Pollution Prevention Act (APPA) - based on the British Clean Air Act

- Forest Sector Transformation Charter

- Protection of Informal Land rights Act (Act 31 of 1996)

- Communal Land Rights Act (Act 11 of 2004)

- Forest Stewardship Council (FSC) - ISO 14001

- South African Forestry Company Ltd - SAFCOL

- Atmospheric Emissions Licenses (AELs)

- Commission on Restitution of land Rights - CRLR

- Etc.

Location

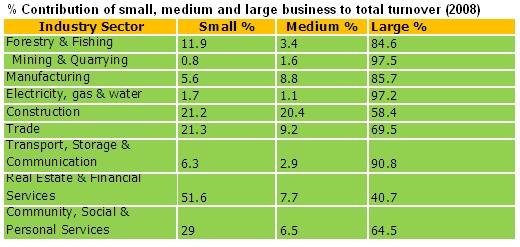

Map 1 presents the spatial analysis of the agri-sector in Mpumalanga. The highest land use is forestry.

The following map provides a national picture of key sites for pulp and paper mills in South Africa.

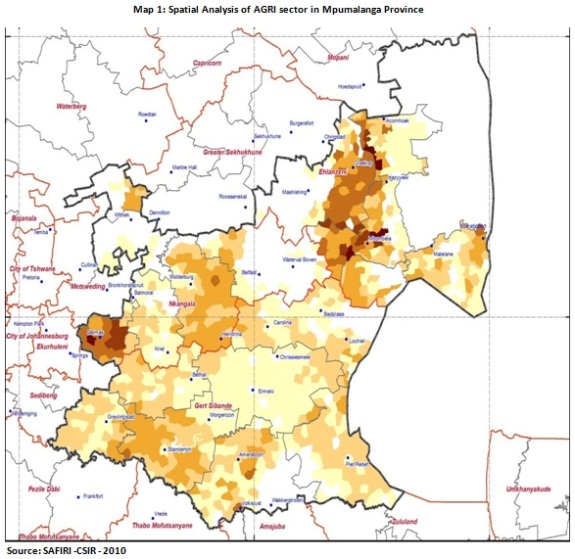

Further, when assessing the highest concentration of commercial plantations nationally, Mpumalanga and KwaZulu Natal (KZN) Provinces have the most at 47% and 40%, respectively. See graph 3 below:

Mpumalanga Province

The province has two main areas where the forest industry is located, the north and south Mpumalanga. The northern section consists of the following areas: Barberton, Lydenburg, Mapulaneng, Nelspruit, Pilgrim's Rest and White River. The southern section consists of Carolina, Eerstehoek, Ermelo, Piet Retief, Wakkerstrom and Waterval Boven. Consequently, the sector's distribution (inbound and outbound) reflects these locations depending on type of species and processing conducted in each zone.

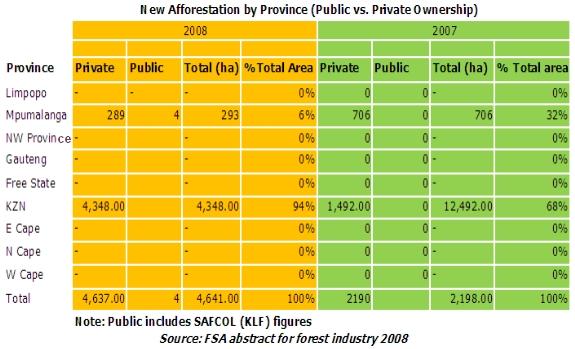

The approximate total hectares for hardwood species in Mpumalanga North in 2008 was 62,906 ha while Mpumalanga South had 128,772 ha. Table 7 below presents new afforestation by province. Mpumalanga has the second quantity at 293 ha (both private and public) while KZN has the highest at 4,348 ha.

The next graphs show price deferential between product species from 2008 to 2009. The importance of this variation is due to the increased levy (from 110 cents to 128 cents per ton) applied to industry by government. The resultant sales were significantly down. It has produced a deficit of 14.4% compared to 2008 figures.

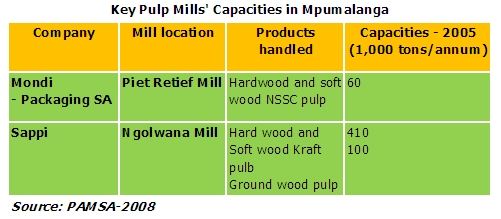

Paper and Pulp Capacities in Mpumalanga

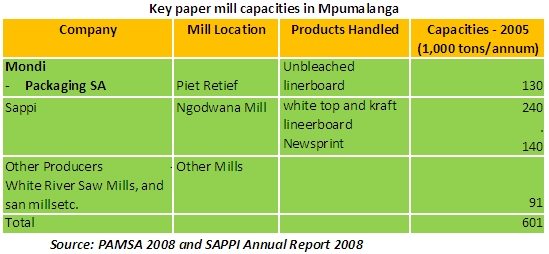

The general overview of paper, pulp and board mills in SA sits at 33 with the majority located in Mpumalanga and KZN. Excluding products earmarked for export (packaging papers), most products are for domestic consumption. The focus for this exercise is Mpumalanga paper and pulp mill capacities in addition to volumes moved in 2009 (projected and documented during the surveys conducted) As stated in the PAMSA 2008 report. The products in greatest demand within the paper conversion industry are the printing and writing grades. Mondi and Sappi are the only producers of virgin pulp in the country and, as such, dominate the virgin fiber based printing and writing markets, as well as the softwood virgin based newsprint market."

Companies such as Nampak and Kimberly-Clark have a combined 50% market share as tissue manufacturers in the country.

Findings on Forest Companies Surveyed

Companies surveyed focused on the top players such as Mondi, Sappi, Komatiland, and York Timbers. A brief summary of each company's product profile; distribution and volumes moved are captured in this section.

Annual Tonnages Transported

Given that the forest industry is largely dependent on 'land-mass" (plantation hectares) of 50,000 to 100,000 plus hectares to be a major player, it has in the past remained competitive by using rail for product movement (export, import or domestic consumption). Forestry products especially in raw form is regarded as "dry-bulk" ; therefore, transportation by rail provides the best economies of scale especially as product is heavy and is usually destined for further centers of beneficiation/processing and eventual export or import. Moving over 14,261 million tons (nationally) in 2009 makes the case for demand that Freight rail (Transnet) be more responsive to efficiencies and costing models that will facilitate transportation cost and industry competitiveness in the global markets. Summarized figures of tonnages moved by either rail or road as follows: inbound ~2,736,077 and outbound ~ 875,000.

Transport Modal Usage and Transport Trends

As previously stated the forest industry moves large volumes of product regardless of state of material i.e. raw state of timber/round woods/softwoods, etc. Even after processing, i.e. pulpwood products, paper reels, etc; large volumes for this industry is the name of the game. The products also have handling methods that make the value-chain of the industry unique. Whether it is processing fibers into paper products; pulp, etc. the quality of the by-products at all stages is critical to retaining market share and quality products for a discerning consumer.

In recent years most companies used rail (Transnet Freight Rail) as the most cost effective mode. However, due to many challenges within TFR such as efficiencies; costs and quality of service overall, the shift from rail to road continues at an alarming pace. Most of the companies surveyed outsource the movement of their product with freight logistics companies such as Value Logistics; Imperial, specialized transport companies as well as actually owning their own fleet. Of the companies surveyed less than 20% use rail exclusively. The majority either have moved to road using the reverse logistics for sharing freight costs and vehicles.

Copyright © 2010 Mpumalanga Province Freight Transport Data Bank [ - ]

All rights reserved.

This website conforms to W3C Standard [ - ]